On whatever personal level you connect with the issue of bias and racism – or don’t – the numbers don’t lie.

Here’s a lay of the land:

In June 2017, I was sitting in the first row at the Kauffman ESHIP Summit in Kansas City as Melissa Bradley, founder of 1863 Ventures took the stage to talk about the economic imperative of investing in the New Majority. What follows are her most important points but I implore you to watch the recording because her delivery is 100% more engaging and powerful than merely reading her words here. Read or watch away:

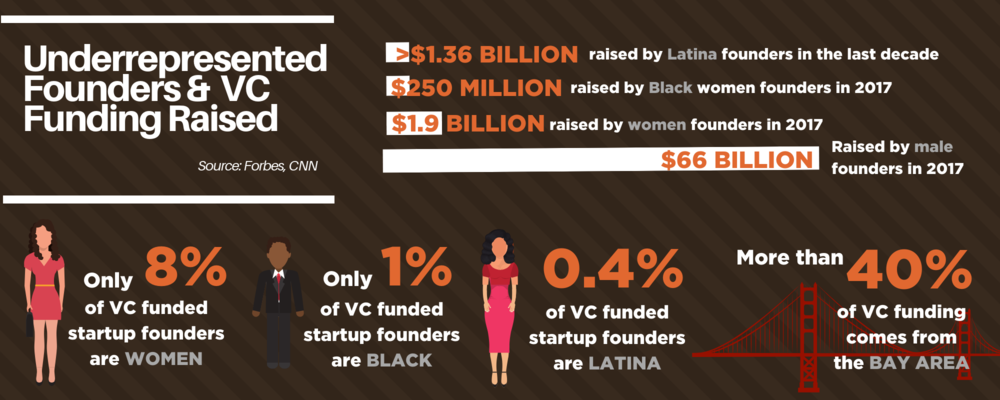

8% of venture capital deployed in the US goes to women, and only 1% to African American women.

Melissa Bradley, ESHIP Summit 2017

Did you know that of all the venture capital money that is deployed, only 8% goes to women, and only 1% to African American women? Did you know that only 7 % of the top 100 VC firms have women as partners? Here’s one that frustrates me on a regular basis: Did you know that one in three LGBT entrepreneurs who are seeking funding or securing funding are not out to their investors?

These are just a few of the challenges that are causing breaks in equity and equality in our current entrepreneurial ecosystems.

By 2055, the United States will not have a single racial or ethnic majority. In fact, 56% of the population will be the New Majority.

Melissa Bradley, ESHIP Summit 2017

I’m sharing these statistics because of an economic imperative. The minority population is the New Majority. 43% of Millennials are non-White. By 2055, the United States will not have a single racial or ethnic majority. In fact, 56% of the population will be the New Majority. 40% of the labor force will be women and I’m happy to say as I approach 50, the population will tilt a little older.

“We – as people of color – have been conditioned to do everything smaller and at a different scale that our revenues are missing several zeros at the end compared to our white counterparts. We’re making hundreds of thousands of dollars in the startup world, but they’re making millions of dollars. And some of that is a Catch 22.”

Melissa Bradley, The Keystone ep. 24

The challenge is that these are not the people that typically make up our entrepreneurial ecosystems. So we’ve got to figure out how to invest in them. Because if we don’t invest right now in those who have been historically marginalized, underinvested in and undereducated, then we will continue to erode the competitive advantage that exists in our country.”

Melissa goes on to extrapolate the economic cost of undereducation and unemployment among African Americans in the United States – a whopping 4% of gross domestic product (GDP) in case you’re wondering – and highlights the opportunity cost of not investing in diversity:

“Women CEOs in Fortune 100 companies – surprise surprise – drive three times more value than those guys at the S&P 500. We know that companies with women on the Board of directors perform better: 66% return on investment on capital, 3% return on equity and 42% return on sales. We know that venture-backed women-owned companies perform 63% better than investments in all-male founding teams. And we certainly know that if a venture capitalist invests in a woman, they’re going to make money and save money: They’re going to generate 12% higher revenue than men, use one third less committed capital and have 15% to 25% lower failure rate. Who knew?

Venture-backed women-owned companies perform 63% better than investments in all-male founding teams

Melissa Bradley, ESHIP Summit 2017

The Center for Women’s Business Research says that there are eight million women-owned businesses right now. They have an economic impact of $3 trillion. That equates to 23 million jobs or 16% of all jobs in the United States.

Let’s talk about African-American entrepreneurs. There are over two and a half million black-owned businesses which represent just over 9% of all firms in the US. These firms generate $150 billion in revenue supporting just under one million jobs. We know that black businesses are not only the fastest growing but the most resilient. In those four tough years that we call the Great Recession, we soared at a 38% growth rate. We know that Black women business owners – surprise – outpace all other startups six times the national average.

Black businesses are not only the fastest growing but the most resilient.

Melissa Bradley, ESHIP Summit 2017

Past and present discrimination has caused the loss of 1.1 million businesses that could have been created which would have created 9 million jobs which could have added $300 billion to the bottom line.

Let us not forget about immigrant entrepreneurs who are clearly under fire right now. We know that they have been the leaders in technological innovation contributing $1.6 trillion to the US GDP. More importantly, they have been significant tax drivers despite what we read in the newspaper. In 2010, immigrant-founded small businesses generated more than $775 billion in sales, $126 billion in payroll taxes. They’re paying more than Apple and the rest of them combined, there is no offshoring here.

In 2010, immigrant-founded small businesses generated more than $775 billion in sales, $126 billion in payroll taxes.

Melissa Bradley, ESHIP Summit 2017

That’s a lot of economic opportunity we are not realizing… I truly do believe that we all want economic prosperity, I truly believe that we want the best for ourselves and our communities. But we don’t know how to do it. We often times fail to realize that everyone has the opportunity to contribute provided they’ve actually been given the chance to participate.

It is important for you to know that your acknowledgment of racism does not make you responsible; however, your inaction and denial of its existence makes you an accomplice to perpetuating America’s greatest sin.”

To hear more about what Melissa Bradley is up to and hear her current take on the VC landscape, listen to her most recent interview on The Keystone Podcast!

Innovation Blind Spots

In 2017, Ross Baird, then CEO of Village Capital – the world’s largest organization supporting impact-driven founders – already raised the flag on our skewed view of race and equity in entrepreneurial ecosystems, and the VC world in particular. In The Innovation Blind Spot, he writes:

“Huge parts of the [capitalist] system aren’t working…. And the structural problems in the system make all our other problems nearly impossible to solve. Even though we have more computing power in our pockets today than the entire world did fifty years ago, our food systems struggle to feed the world’s growing population, and our health and education infrastructure can’t take care of the current generation, let alone prepare the next one to lead.” (Baird 2017, p. XV).

You would think that with all the scientific and technological progress that we have made over the last two decades, entrepreneurial innovation should be able to solve these problems by now. And we are not short of ideas, we are short of pathways to bring these ideas into the world. And that’s the key argument in Baird’s theory:

“The idea that entrepreneurship is a meritocracy is a myth. In the real world, money flows to the ideas that are the most convenient to find or the most familiar, not necessarily those that are the best. Simply put, the blind spots in the way we innovate – the way we nurture, support and invest in new ideas – make all our other problems even harder to solve.” (Baird, 2017, p. XVI)

The idea that entrepreneurship is a meritocracy is a myth. In the real world, money flows to the ideas that are the most convenient to find or the most familiar, not necessarily those that are the best.

The Innovation Blind Spot, p. XVI

“We found that by controlling for similar industries and geographies, female-run companies outperform male-led firms by at least 20% in revenue earned and full-time and part-time jobs created, yet still attract only 80% as much equity funding as male-run companies.” (Baird, 2017, p. 59).

Back in 2017, Ross Baird had hard data to prove that the then-current VC landscape was not interested in solutions that took place outside of these startup hotspots led by anyone not male. In chapter two, he argues that most investment decisions are based on

- Where you are (“Since the mid-’90s, funding for startups has increased by 300 percent in California, New York and Massachusetts.” p. 25)

- Who you know (“In order to manage the constant stream of startups coming their way, investors often rely on ‘warm introductions’ from friends and colleagues.” p. 26)

- What you look like “[I]dentical resumes wit the names “Greg” and “Emily” received 50 percent more call backs than those with the names “Jamal” and “Lakisha” p. 28), and

- What you’re building (“In the Valley […] people are looking to solve their own problems, looking for things to build for the top 10 or 1 percent.” p. 14)

He goes on to explain that “78% percent of startup investment in traditional venture capital in the United States (and 50 percent worldwide) goes to California, Massachusetts, and New York. In our portfolio, only 10 percent of the companies are from those three states.” (Baird, 2017, p. 61).

Moving Beyond Inclusion: Regenerative ecosystems

Fay Horwitt, inclusion expert and advocate, ecosystem builder and president at Forward Cities calls on ecosystem builders to act as ecosystem healers. In her 2019 article Moving Beyond Inclusion Fay argues:

By promoting and shining a light on inclusion, we help ensure that the pool of entrepreneurs being served and supported within an ecosystem is diverse and that there is an intentional effort to include everyone.

Fay Horwitt, Moving Beyond Inclusion

“However, […] ecosystem builders must be bold enough to look even further ahead and forge a path toward something even more necessary: regeneration. I believe that we, as the pioneers of this emerging field, have an opportunity (and perhaps, an obligation) to envision and strive for better in this area.”

To aim for inclusion is limiting. It comes with an implicit assumption that the best we can do is to assimilate those that have been systemically excluded into the very broken systems that are the root cause of the disparity.

Fay Horwitt, Moving Beyond Inclusion

“Inclusion presupposes that an individual or entity holds a measure of power over someone that allows them to invite or allow that individual to participate. While inclusion can have positive results, in some ways, it negates the individual’s own agency to be a part of the economy or ecosystem without someone else’s permission or provision. This can sometimes have the result of dis-empowering the very individuals that allies seek to empower. This dynamic can prevent an ecosystem and a community from achieving its full potential.”

Inequity is created when the natural and equitable flow of ideas, talent, and resources within and between these ecosystems are blocked by artificial barriers.

Fay Horwitt, Moving Beyond Inclusion

I believe that ecosystem builders are in a unique position, as we shape the DNA for this emerging field, to do it in a profoundly different way that completely upends these archaic and limiting power dynamics. Open racism, sexism, and xenophobia are no longer politically correct; so for those inclined to those toxic ideals, simply ‘opening the door’ to increase diversity meets cultural expectations and appears PC.

A regenerative entrepreneurial ecosystem is a community of trusted stakeholders acting together to create the conditions that inspire, foster, and promote the equitable flow of talent, information, and resources that help all entrepreneurs launch and grow businesses, creating shared prosperity for the entire community.

Fay Horwitt, Moving Beyond Inclusion

Regeneration will require being willing to see your local ecosystem through a new lens, pop the hood, and discover what may be unseen upon first glance. It will also require not just deep thinking on these issues and empathy, but a willingness to turn that empathy into action with a focus on the following key principles”:

- Access

- Belonging

- Inclusion

- Diversity

- Equity

To learn more about Fay’s theory of change through Regenerative Ecosystems, read her latest publication Ecosystem Healing: Call to Action for the Entrepreneurial Ecosystem Building Field | Part 1!

Take informed action

This series is an attempt to lift the hood on systemic discrimination in the United States; trying to touch you on both the human, individual level and the level of a changemaker operating in a system that is ripe for disruption. I sincerely hope that you, dear reader, find yourself in both of them.

You might wonder where to go from here and I’m sorry to report that there is no one approach that will work for every reader alike. I recommend the following framework:

For those of us who are only just waking up to systemic injustice, the conversation around dicrimination against the New Majority and resulting actions are a lot to wrap our heads around. None of this is supposed to be easy, or comfortable, or straight forward. And that’s ok. We have a lot to catch up on but that doesn’t mean it can’t be done. As Ace Callwood says in The Burden of (Finally) Being Seen: “If you want to help, sit with your discomfort for a minute. I need you to not know how to change things and be torn up about it.”

Find your lane. There are many ways to protest, to speak up about injustice and put your allyship into practice. Find what works for you and do not be afraid of feeling uncomfortable. Discomfort is a good proxy for progress. Make sure that you move ahead in a way that is sustainable. We are in this for the long run. But whatever you do, don’t be silent or a bystander. Speak up!

Know and understand that everyone is biased. Become self-aware, read Tiffany Jana’s books and go through each individual exercise listed. You’ll be surprised what you will learn about yourself and community. Once you’re done with all these books, expand your knowledge – read more, watch more, listen more. At the end of this series you will find a number of resources to continue your journey.

This is not a political issue, it is a human rights issue. As someone who wants to support entrepreneurs in her/his community – be it as a customer, investor, mentor or whatever else – understand that by not investing in the New Majority, we are shooting our economy in the foot. Not only do I hope you have gained a personal connection to the issue but I hope you understand the economic implications of the status quo. The next time you are in a position to advocate for New Majority entrepreneurs, use the facts and data that Melissa Bradley and Ross Baird have shared with us. While it may be hard to believe in the current political climate in the US, it is still hard to argue statistics and facts. Know your numbers and use them as a tool to drive more equitable access to economic opportunity.

For those of you who understand themselves as ecosystem builders, follow Fay Horwitt’s call to not stop at Inclusion but to move beyond to a place where we can help entrepreneurial ecosystems heal. As we are moving toward regenerative ecosystems, continue to do the work, be patient with yourself and those who we are trying to win over.

This resource guide is no longer available for download. To stay in the know (and never miss another resource), join Impact Curator: